vermont income tax refund

Vermont State Tax Refund Status Information. Department of the Treasury.

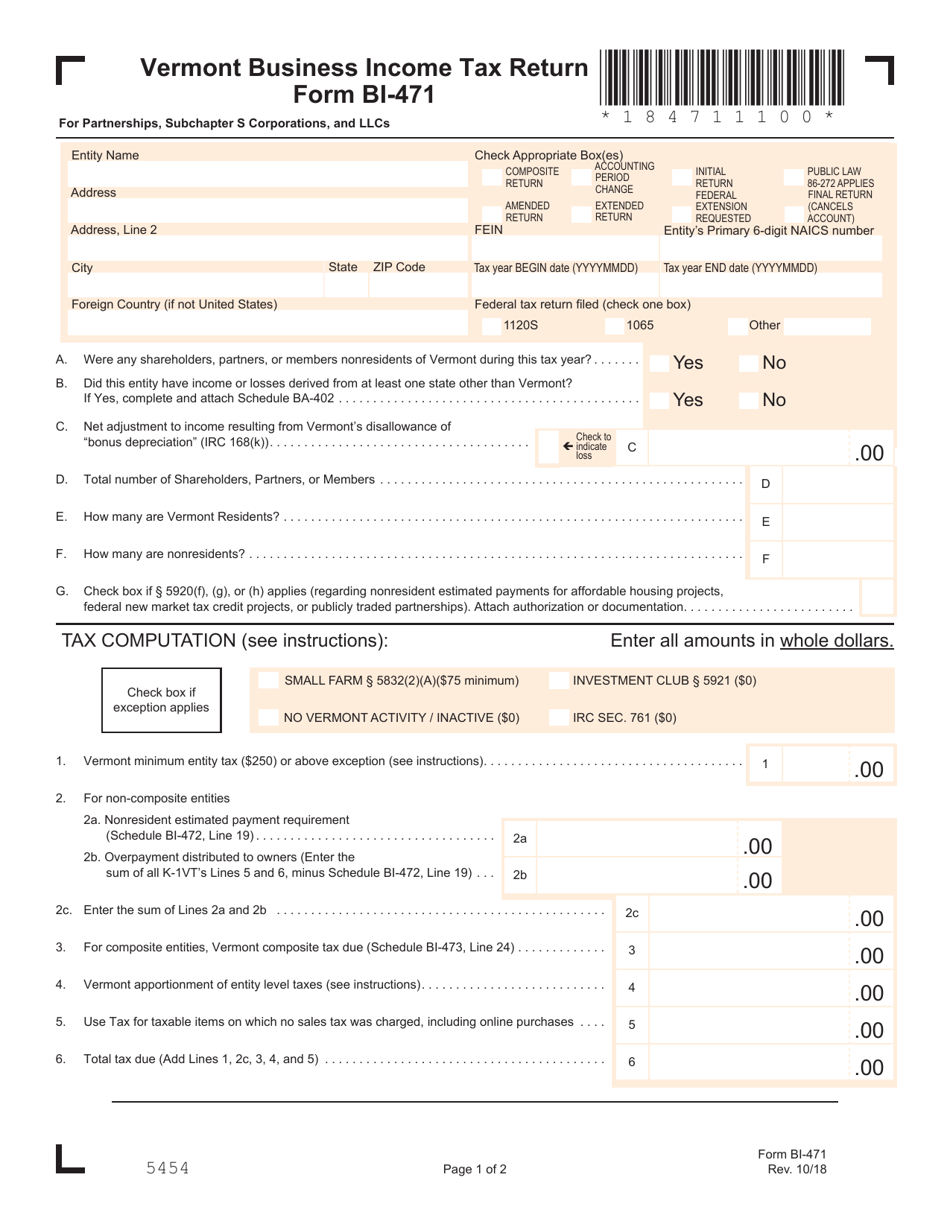

Vt Form Bi 471 Download Printable Pdf Or Fill Online Business Income Tax Return Vermont Templateroller

Vermont income taxes are imposed on individuals and entities taxpayers that vary with the profitable income.

. For returns filed by paper. Adoption of federal income tax laws Section. Sales and Use Tax.

Pay Estimated Income Tax Online. Vermonts EITC state law allows a resident to receive a tax credit of 32 percent of the amount the taxpayer receives from the federal EITC. Name of tax 5822.

Sales Use Tax Form SUT-451. The 2022 state personal income tax brackets. Extensions - A 6-month extension is available to extend the filing of a Vermont income tax return by filing Form IN-151 - Application for Extension of Time to File Form IN-111.

Printable Vermont state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. This form is only. Pay Estimated Income Tax by Voucher.

Allow up to 8 weeks for processing time. 18000 taxable income pay 644 which is an effective rate of. Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff 802 828-2505 Department Directory.

Taxvermontgov You can help us speed up the processing of your return and refund by. Allow up to 8 weeks for processing time Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status. Kansas City MO 64999-0002.

If you are due a refund or dont owe any tax mail your return to Vermont Department of Taxes PO. Get your Vermont State Tax Refund Status. If you are a Resident Nonresident or Part Year resident you must file a Vermont income tax return IF.

To check the status of your. Pay Estimated Income Tax by Voucher. Ad Learn How Long It Could Take Your 2021 State Tax Refund.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate Claim and Estimated Payments. The Vermont income tax rate for. For the state EITC Vermonters must first.

866 828-2865 toll-free in Vermont Email. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. Find out when your Vermont Income Tax Refund will arrive.

Vermont income of individuals estates and trusts 5824. Then click Search to find your refund. See How Long It Could Take Your 2021 State Tax Refund.

And you ARE ENCLOSING A PAYMENT then use this address. Vermont State Income Tax Return forms for Tax Year 2021 Jan. Business Income Tax Return for Vermont Residents Only For qualifying businesses owned exclusively by Vermont residents.

Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. Box 1881 Montpelier Vermont 05601-1881.

Click on Check the Status of Your Return Personal Income Tax Return Status. Tax on income of individuals estates and trusts 5823. Taxpayer Services 802 828-2865 Mon Tue Thu Fri 745.

Property Tax Credit. Please wait at least three days before checking the status of your return on electronically filed returns and six. Pay Estimated Income Tax Online.

Not sure what tables Dave is looking at but the 2012 Resident Individual Income Tax Return booklet shows this. If you file a. File state taxes for free.

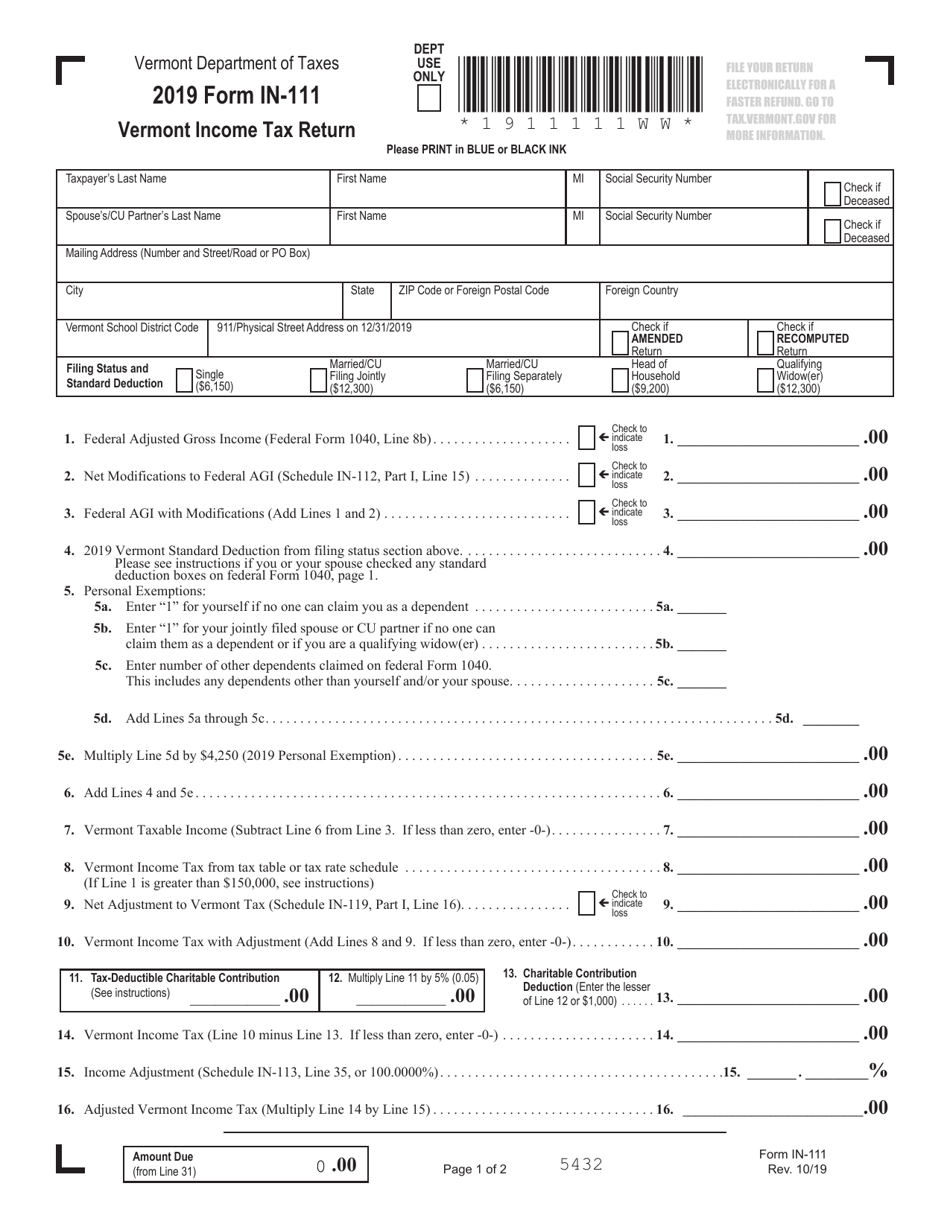

Filing an Amended Vermont State Tax Return To make a correction to the Vermont tax return you filed use Form IN-111 for the year you are amending. Use a tax professional or volunteer assistance to prepare and file your return. How Do I Pay My Vermont State.

Vermont Department of Taxes. You are required to file a federal. Property Tax Bill Overview.

According to Vermont Instructions for Form IN-111.

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Personal Income Tax Department Of Taxes

Filing A Vermont Income Tax Return Things To Know Credit Karma

Vermont Tax Forms And Instructions For 2021 Form In 111

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Where S My Refund Vermont H R Block

Where S My Vermont State Tax Refund Taxact Blog

Form In 111 Vermont Income Tax Return

Form In 111 Vermont Income Tax Return

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Form In 111 Vermont Income Tax Return

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes